Champion-Challenger Collections Model

Competition brings out the best in us. Keep that in mind when considering what to do with your accounts receivables. Having a single, reliable collection agency partner may prove successful. But do you ever wonder if your collections partner could do better? Rather than leaving one partner and finding another, consider a Champion-Challenger model.

Engaging in a Champion-Challenger model can provide multiple benefits to any organization attempting to improve its recoveries. For example, it can help you determine what type of collection agency works best for you. After all, not every collection agency is the same. Some may have dramatically different strategies and skill sets that could prove advantageous to your business; some may be more or less experienced in your particular industry. This model demands competition between collection agencies and ensures that all competing partners are evaluated in a consistent manner.

But the Champion-Challenger model does more than simply tell you what type of collection agency will serve you best. This model allows your business to design a set of performance metrics or Key Performance Indicators (KPIs), test your plan within a competitive environment, and isolate potential areas of improvement not only with individual agencies but also with how your business pursues account receivables management solutions in the future.

IC System participates in several Champion-Challenger models. We welcome these engagements, as they provide us with additional incentives to further ensure we are delivering upper-echelon results to our clients. A Champion-Challenger framework creates competition and drives collection agencies to perform at their very best.

How Does the Champion-Challenger Model Work?

The typical Champion-Challenger model distributes a particular debt portfolio amid several competitors to reach a specific objective. Perhaps your business wishes to find two of the best agencies to work your entire inventory of past-due accounts, and so it begins the Champion-Challenger model with four competing candidates with the plan of eliminating two. Or perhaps your business wants to test the most effective operational methods of collection, and it resolves to test several strategies at once. Whatever your goals, it is important that they are carefully outlined and agreed upon within your business before a Champion-Challenger model is launched.

The most common Champion-Challenger model is structured around market share allocations. The best Champion-Challenger structures review performance on a scorecard and allocate market share on a quarterly basis. Monthly reviews may not offer sufficient time for an agency to make proper adjustments in their operational approach between rankings. Likewise, if allocation shifts occur at a rate fewer than four times a year, higher allocations could remain with an underperforming agency, and your business may not be receiving the best possible results. The Champion-Challenger model will identify your top collection agency, or agencies, that you can then award with additional market share or incentives. The scorecard model will help you performance-manage your underperforming agencies with the ultimate goal of improving their results or determining that you need to find a replacement.

Allocation shifts to the top-performing collection agency provide a better return to your business, ensuring there is not a large volume of lost dollar opportunities left on the table by an underperforming agency. The lost dollar opportunity consists of the recoveries that could have been collected, had that inventory been placed with a collection agency with a higher performance rate.

Should an agency consistently receive the maximum allotment of placement allocation, there are additional ways to incentivize. Many Champion-Challenger models include bonus dollar allocations or non-cash incentives, such as giveaways. Your business’ branded items (like pens, mousepads, apparel featuring your logo, awards for best call quality execution, or recognition for best call of the month) are always appreciated by your collection partners.

Moreover, Champion-Challenger models can be about more than just recoveries. In today’s collections environment, compliance and call quality are often just as important as recovery rates. If these are not yet priorities for your business, it may be a good time to start introducing KPIs into your Champion-Challenger model that measure back office efficiencies, whether your agency is compliant with certain legal requirements or score a series of monitored collector calls. Because your business controls how your agencies are scored, you can calibrate your KPIs to meet your specific business needs and values.

What Does a Champion-Challenger Model Look Like?

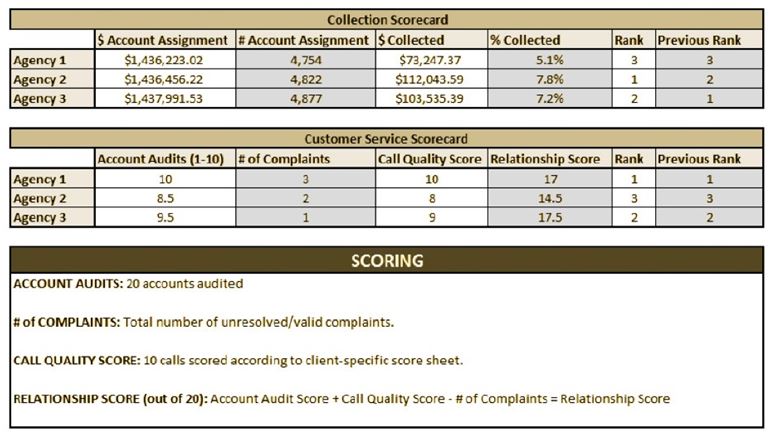

Your scorecard is an essential tool when evaluating your collection agencies in a Champion-Challenger model. Below is a basic example of such a scorecard.

As you can see, the scorecard features a number of metrics on the three collection agencies. In this example, debt allocation has been divided evenly between the collection partners.

As you can see, the scorecard features a number of metrics on the three collection agencies. In this example, debt allocation has been divided evenly between the collection partners.

The business has scored the agencies on both collection and customer service. Based on these numbers, the business has ranked their agencies. Agency 2 appears to be the highest collecting agency, but they are in last place for customer service. Agency 3 is a close second for collections, whereas they are ranked at the top for customer service.

This hypothetical business does not provide its agencies with an overall score. Rather, they evaluate their two scorecard elements individually to ensure that performance and their customer experience with the agencies are measured separately.

In this example, the business has decided to measure the following metrics:

- Collection percentage: This is measured by dollars collected divided by the assignment dollars.

- Account Audits: In this metric, the business and agencies have agreed upon a set of proper work standards and deliverables. These deliverables are reviewed at an account level; they are measured for accuracy and completion within guidelines. These may include:

- Customer correspondence (letters, texts, emails), including the validation notice, charity applications, dispute responses, and much more.

- Call attempts within specifications.

- Accurate documentation in account notes.

- Credit reporting, which includes the timeliness of the first report to the credit reporting agencies, ensuring the tradeline has been removed if requested, and accuracy of the overall tradeline as reported to the bureaus.

- Call Reviews: The business monitors 10 collection agent calls from each agency and scores them based on a set of mutually agreed upon call standards.

- Complaints: In this case, the business counts every unresolved or valid complaint against the respective collection agency.

- Relationship Score: This score provides the business with an overall measurement of how well the agency manages its customer service.

While the above example considers very broad metrics, businesses can use a fine-tuned approach to capture more detail. Your business might consider scoring on how many accounts were resolved in full, how many customers reinitiated service after being in collections, or how timely the collection agency’s client service department provides reports and responses to inquiries.

IC System: Your Champion-Challenger Expert

IC System participates in several Champion-Challenger models and, whenever possible, recommends them to our clients. We welcome these engagements, as they provide us with additional incentives to further ensure we are delivering upper-echelon results to our clients.

If your business has questions or would like more information about the implementation of a Champion-Challenger model, IC System welcomes the opportunity to discuss the subject in more detail.

About the Author: Eric Johannes